As a nation, student loan debt is over $1 trillion. Millennials are not the only generation fighting the snowball of student loan debt. 26 percent of Generation X workers and 13 percent of Baby Boomers have student loan debt.

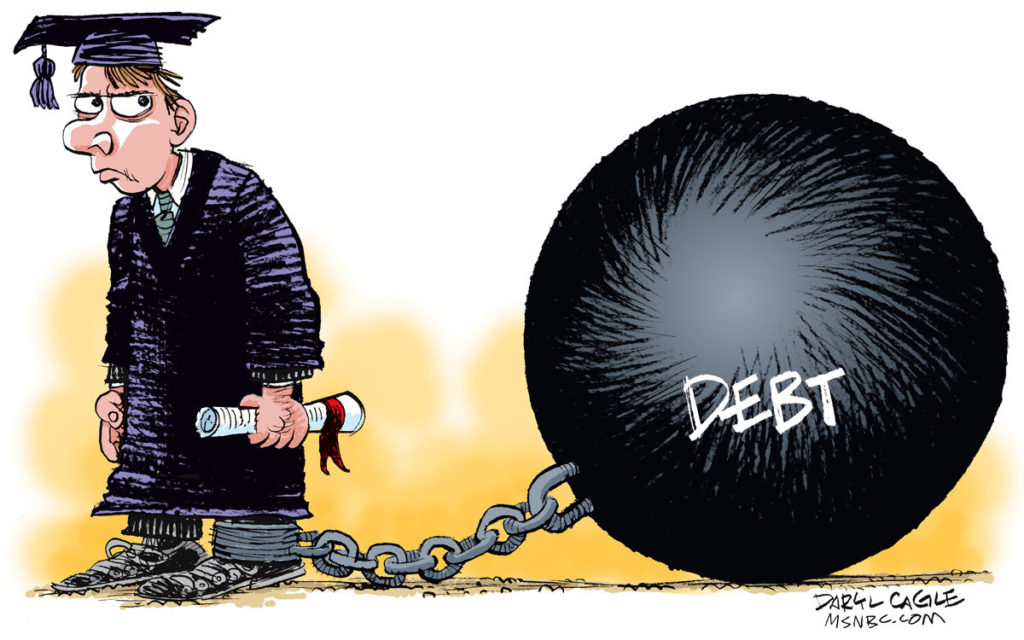

For Millennials, student loan debt can be a suffocating overwhelming battle. Figuring out where to start with paying off student loan debt is a foggy forecast. The graduating class of 2016 has an average amount of $40,000 in student loan debt. Finding a balance of paying off that debt while also looking at short-term goals like finding a place to live, buying a car, or even long-term goals like retirement is like balancing multiple plates on poles. Often times, millennials chose to not save for retirement as a way to pay off the current debt they face. This is not the best move as many employers offer matching 401(k) options, which is an easy way to save more money for retirement with a small amount dedicated to retirement every paycheck.

Most experts recommend setting aside three to six months of living expenses. Although this amount can initially be daunting, start small with a goal of $400-$500 in savings. Build upon the goal once it is achieved. By building on savings goals, your confidence in saving will grow as well.

Many Gen Xers, have growing families and are in the best time of their lives for earning and saving for retirement. However, they are facing the daunting task of saving for their child’s education, paying off a mortgage, or other financial obligations they may have. As a tip if this is your situation, check with your company about financial help tools they may offer. Speak with a financial advisor to assess your finances and optimize your efforts to save and pay off debt. This will help you identify the how and where to focus future efforts for your finances.

For Baby Boomers, they have $66 billion of the debt as of 2015. When it comes to student loans taken through the Department of Education, the government may even be able to garnish Social Security payments for those that may default on payments. Talk about daunting! A tip would be to look at re-amortizing the student loan; this will lower the current monthly payment but will lengthen the total loan repayment period. Additionally, just like the Gen Xers, speak to a financial advisor, as they can help assess your specific situation in detail.

Warmest regards,

Stacia