As millennials begin to make up more than 75% of the U.S. workforce by the year 2025, they are demanding a change in benefits that…

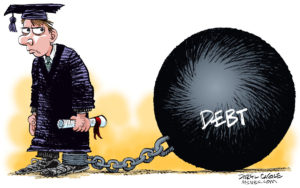

As a nation, student loan debt is over $1 trillion. Millennials are not the only generation fighting the snowball of student loan debt. 26 percent…