Have you heard the term “telemedicine” before this article? If not, you have probably used it. Dictionary.com defines telemedicine as “the diagnosis and treatment of…

School has started, the days are getting shorter, the nights are getting cooler, and before you know it, the holidays will be here begging for…

Disability Insurance Is Vitally Important We have gathered information to help you look at your risk of income interruption and the value of disability insurance.…

Colonial Life now offers America’s employers customizable accident protection that helps protect their financial well-being. When an unexpected injury happens, accident insurance pays benefits to…

Limiting certain foods and eating more of others is the actual key to healthy eating for your heart, experts say. To help keep the right…

Data is in from the “America Saves Week” that was February 27th – March 4th this year, and the survey revealed important pieces of information…

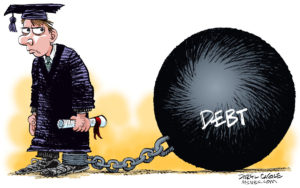

As a nation, student loan debt is over $1 trillion. Millennials are not the only generation fighting the snowball of student loan debt. 26 percent…

Facebook is more than a platform for sharing pictures and connecting with friends; it is a marketing platform of many business tools that allow a…

Other than keeping track of your income, mileage and your expenses there is something else you can do now to help you with next year’s…