Time. There never seems to be enough of it yet there is always the same amount available in every day. In business, time is one…

We all know that getting old means having more memories and our bodies start to wear down year by year. But when is a “side…

Take a moment to flash back to January 1, 2017. What were you doing? Who were you with at the time? What were your life…

School has started, the days are getting shorter, the nights are getting cooler, and before you know it, the holidays will be here begging for…

As the holidays begin to quickly approach around the corner, employers need to begin thinking about when their employees will be taking their time off.…

Limiting certain foods and eating more of others is the actual key to healthy eating for your heart, experts say. To help keep the right…

Data is in from the “America Saves Week” that was February 27th – March 4th this year, and the survey revealed important pieces of information…

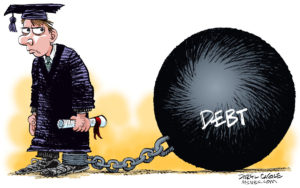

As a nation, student loan debt is over $1 trillion. Millennials are not the only generation fighting the snowball of student loan debt. 26 percent…

Facebook is more than a platform for sharing pictures and connecting with friends; it is a marketing platform of many business tools that allow a…

Other than keeping track of your income, mileage and your expenses there is something else you can do now to help you with next year’s…